IRMAA stands for Income Related Monthly Adjustment Amount. This represents the additional Medicare Part B and Part D premium(s) that Medicare eligible people may have to pay if their income exceeds certain thresholds.

In case you are new to Medicare and don’t fully understand what it costs, Medicare eligible people pay a monthly premium for both Part B (Medical insurance portion of Medicare) and Part D (prescription drug portion of Medicare). Those premiums are based on how much income your earned two years ago.

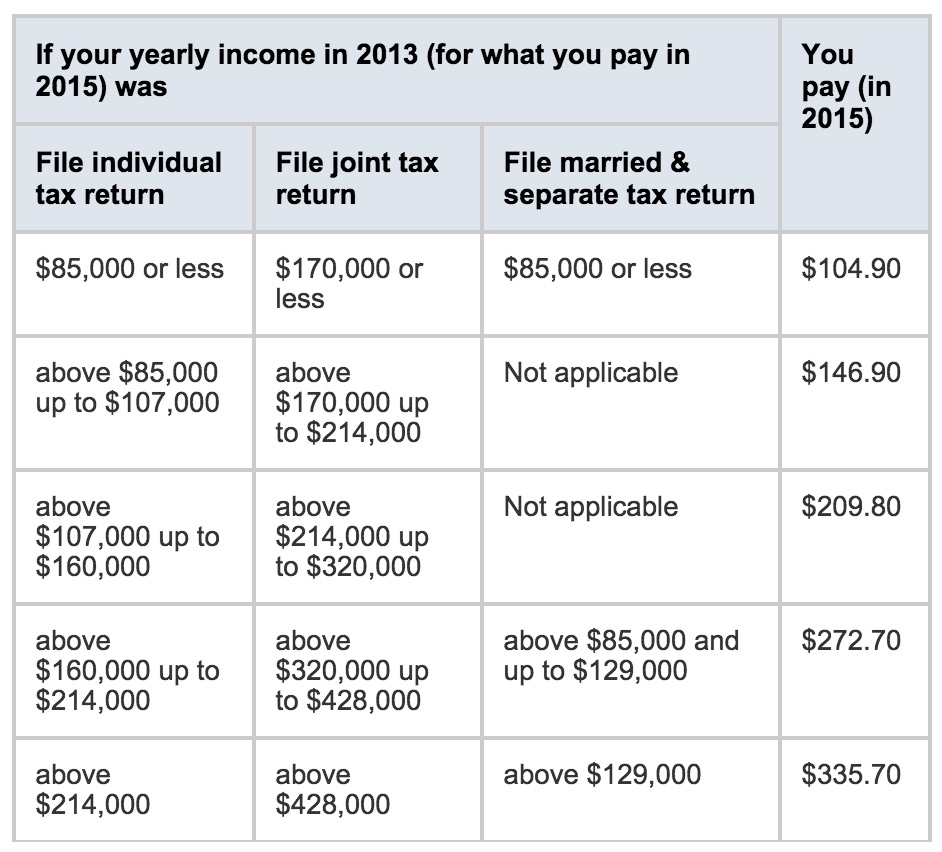

In 2015 the base premium amount for Part B is $104.90 per month, meaning that the least you would pay for Part B is $104.90 per month.

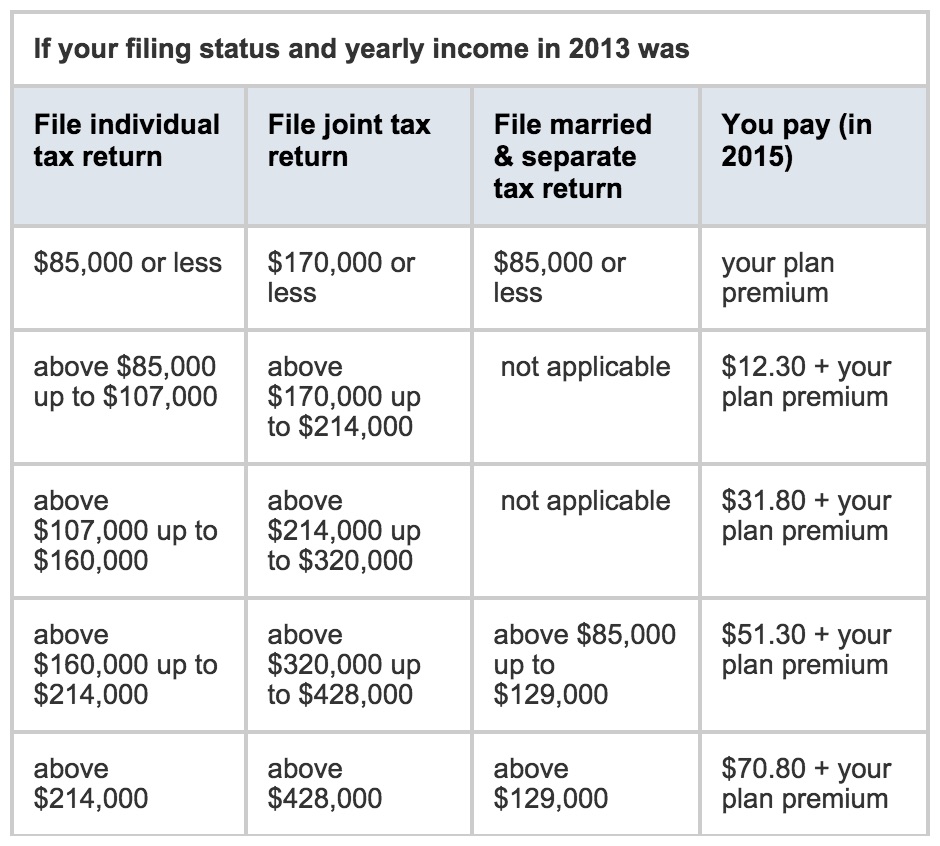

The Part D premium is not a fixed monthly premium like Part B. The Part D premium is plan-dependent, meaning that it all depends on which Part D plan you ultimately choose. They (Part D plans) all have different premium amounts.

It’s important to understand that the IRMAA is based on your adjusted gross income from two years prior, meaning that your 2015 IRMAA amount would be based on your A.G.I. in 2013.

Not everyone pays an IRMAA.

Again, it’s only for people who earned above certain amounts two years ago. You will know if you have to pay an IRMAA because Social Security will mail you documentation outlining what your IRMAA is.

There are certain life events that allow you to challenge or appeal your IRMAA such as marriage, death of a spouse, loss of employment or reduction in hours, loss of pension, etc..

2015 Medicare IRMAA for Part B (Medical Insurance)

2015 Medicare IRMAA for Part D (Prescription Drug)

If you have further questions about IRMAA or Medicare, or need help selecting the right Medicare Supplement plan, or Prescription plan, please contact me directly for help at 484-631-0303.